Corporate strategy

and finance

Since 2001 Clarium has worked with corporates and entrepreneurs, experiencing the challenges together with them and the difficulties, the successes and failures, the risks and opportunities in Italy and all over the world, joined by the same desire to grow and explore new ways of doing business.

What distinguishes the relationship with our clients is the ability to develop and build lasting relationships, with the intention of being renewed, going beyond the single project, because they are founded on a total trust commitment with the goal of ensuring the achievement of concrete results.

The real professionalism of the team of consultants ensures maximum efficiency, thanks to the application of flexible solutions that are always placed into context, able to involve the corporate structure and satisfy the expectations of our Clients.

Strategy and management

We support our clients in the reorganisation of control systems, the redefinition and optimisation of industrial processes and the implementation of management control.

Corporate finance

We carry out consulting activities in the field of corporate finance standing by the Client in the optimisation of their own financial structure.

Energy

In this context we stand by the Client in resolving ordinary and extraordinary energetic problems. The model of intervention provides a constant dialogue with the Client as well as with working sessions at the company too.

Evaluation

We assist banks, leasing companies and industries in defining the economic significance and some sensitive parameters related to assets of evaluation.

International support for the enterprise

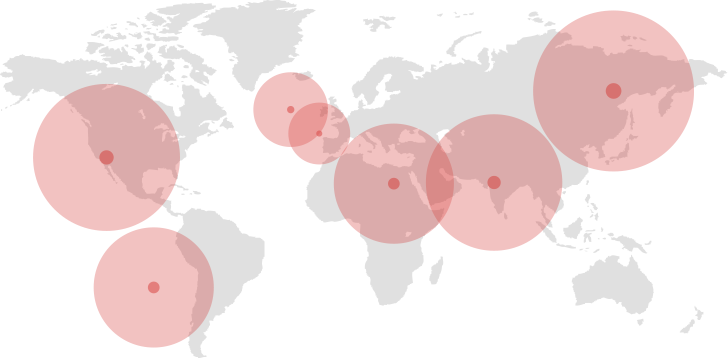

Thanks to its network of skilled collaborators, Clarium is also able to support the client internationally. Over the years, Clarium has managed projects in different geographical areas, both in European countries and outside Europe.

Clarium is directly present in India through Clarium Advisors Pvt. Ltd. , the Indian subsidiary of Clarium, with offices in Mumbai and Pune, works in partnership with the consulting company Damania & Varaiya.